The Advantages and Disadvantages of Car Subscriptions Compared to Traditional Car Buying

Drivers today face an important choice between two completely different mobility solutions: the traditional car purchase and the modern car subscription. This decision raises many questions, especially when searching for a cost-effective and practical solution that fits one’s lifestyle.

Our relationship with mobility has changed dramatically. Flexibility is becoming increasingly important, while at the same time, we are more cost-conscious and prefer sustainable solutions. It’s no surprise that car subscriptions are gaining more attention as a serious alternative to traditional car ownership.

In this article, we will look at both options in detail and analyze their pros and cons. You’ll discover which model best suits your needs and which factors really matter in making this decision.

What Is a Car Subscription and a Traditional Car Purchase?

Car Subscription

A car subscription is an innovative mobility concept that sits between short-term rentals and long-term leasing. You subscribe to a vehicle for a specific period, usually between 3 and 24 months - and pay a fixed monthly fee.

The key advantage lies in the cost structure: almost all expenses are included in the monthly price. Vehicle use, insurance, taxes, maintenance, service, and registration are covered by the provider. You only pay for fuel or electricity for electric cars. This solution offers a worry-free driving experience without long-term commitments or unexpected costs.

Traditional Car Purchase

When buying a car in the conventional way - whether paying in cash or financing, it becomes your full property. You decide how long to use it and when to sell it.

However, with ownership comes full responsibility. Purchase price, depreciation, insurance, taxes, maintenance, repairs, and registration are all on you. Car buying represents a long-term investment and a traditional ownership mindset. You have complete control over the use but also bear all the financial risks.

These two models represent fundamentally different philosophies: purchasing emphasizes ownership and long-term commitment, while subscriptions represent a flexible, modern approach where use is more important than ownership.

Car Subscription vs Car Purchase - Key Differences

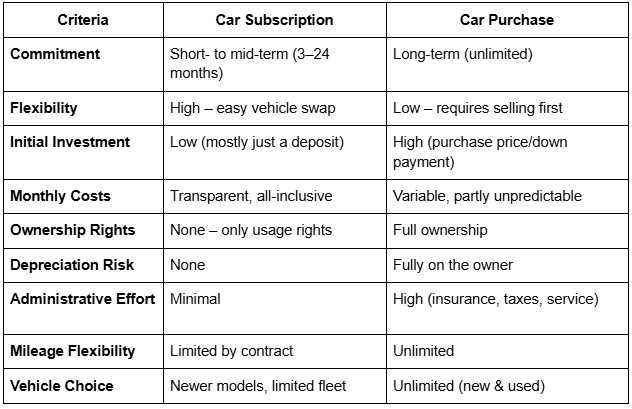

Here’s an overview of the main differences between the two:

Contract Duration & Flexibility

Car subscriptions offer unbeatable flexibility. Contracts typically start at three months and can be extended depending on the provider. After the minimum term, you can easily switch vehicles or cancel the subscription altogether. This flexibility is especially valuable if your life circumstances might change or if you have seasonal mobility needs.

With car ownership, while you can use the car for as long as you like, switching vehicles is far more complicated. You must first sell your current car before buying a new one, a process that takes time, effort, and often results in financial losses due to depreciation.

Cost Structure

The cost structure is fundamentally different. A car subscription involves a fixed monthly payment covering nearly all expenses, making financial planning simple. However, the total cost over time tends to be higher than buying, as you pay for flexibility and convenience.

With a purchase, you face high upfront costs followed by ongoing expenses for insurance, taxes, maintenance, and repairs. The biggest cost factor is depreciation, which can be steep in the first years. Over the long term, purchasing can be cheaper - especially if you keep the car for many years and maintain it well.

Responsibility for Maintenance, Insurance, and Taxes

In a subscription, the provider handles all of this. You don’t have to worry about insurance policies, taxes, or scheduling maintenance appointments. In case of issues, you have a direct point of contact.

As an owner, you’re responsible for everything - arranging maintenance, choosing insurance, and paying taxes. While this adds administrative effort, it also gives you full control over how these aspects are managed.

Vehicle Availability and Selection

Subscription providers often focus on newer vehicles with modern technologies, especially electric and hybrid cars. However, the selection is limited to their fleet.

When buying, the entire market is open to you—from brand-new to used cars, including rare models and classics, allowing for far greater customization.

Who Should Choose a Car Subscription? Who Should Buy?

Who Benefits from a Car Subscription?

Digital nomads and expats staying in Switzerland temporarily or moving between locations.

People in professional transitions (probation, fixed-term contracts, or before a career change).

Young professionals seeking their first car without long-term commitment.

Families with changing needs who require different vehicles at different times.

Tech enthusiasts who like driving the latest models without the financial hit of frequent ownership changes.

Eco-conscious drivers wanting to test different propulsion systems before committing long-term.

Who Should Consider Buying?

Long-term users who keep their car for many years.

High-mileage drivers exceeding subscription mileage limits.

People who want to customize or modify their vehicle.

Car enthusiasts and collectors who value emotional connection to their cars.

Long-term savers willing to invest more upfront for lower overall costs.

Self-employed individuals needing to use their car as a business asset for tax deductions.

When Is a Car Subscription Worth It?

Car subscriptions shine in times of change. If you’re starting a new job with a 12-month probation period and aren’t sure if you’ll stay long-term, a subscription gives you exactly the flexibility you need - without a long commitment.

For beginners, a car subscription is an ideal way to gain driving experience without a heavy financial burden. At CARIFY, you’ll even find special offers for new drivers.

The minimal administrative effort is another plus. No negotiating with insurance companies, no booking service appointments, everything is handled for you.

It’s also a great way to try out electric cars risk-free if you’re unsure whether they fit your lifestyle.

When Is Buying the Better Option?

Buying shines if you plan for the long term and have stable mobility needs. If you drive the same daily commute and foresee no big life changes, owning may be more economical.

For high-mileage drivers exceeding 20,000 km per year, buying often makes more financial sense, as subscription overages can get costly.

If you want to build a personal connection to your car or have very specific customization needs, buying is the better choice.

Business owners can also benefit from tax advantages when purchasing a car as a business asset.

What Do the Numbers Say? Cost Comparison

Example vehicle: Mid-size compact car, new price approx. CHF 35,000

Subscription costs (3 years):

Monthly rate: CHF 750, all-inclusive → Total over 3 years: CHF 27,000 (excluding fuel).

Purchase costs (3 years):

Purchase price: CHF 35,000

Depreciation (approx. 40% after 3 years): CHF 14,000

Insurance: approx. CHF 1,200/year → CHF 3,600 total

Road tax: approx. CHF 400/year → CHF 1,200 total

Maintenance & service: approx. CHF 800/year → CHF 2,400 total

Total: CHF 21,200 with resale value around CHF 21,000 after 3 years

At first glance, buying seems cheaper. But when considering administrative work, unexpected repair risks, and reduced flexibility, the difference becomes less clear-cut.

Pros and Cons at a Glance

Car Subscription

Advantages:

High flexibility in contract terms and vehicle choice

Full cost control with transparent monthly rates

No depreciation risk

Minimal administrative effort

No large upfront investment

Access to new, modern vehicles with easy model swaps

Guaranteed planning security with fixed costs

No worries about maintenance, insurance, or taxes

Disadvantages:

Higher overall cost with long-term use

Limited mileage and restricted vehicle selection

No customization or ownership

Dependency on provider

Extra charges for exceeding mileage limits

Car Purchase

Advantages:

Unlimited use and mileage

Potentially cheaper in the long run

Full freedom in choosing and customizing your car

You own an asset

No restrictions on usage or modifications

Emotional connection possible

Tax benefits for self-employed

Disadvantages:

High upfront investment

Full depreciation risk

Unexpected repair costs

Higher administrative burden

More complicated vehicle changes

Capital is tied up in the car

Tax and Legal Differences

Taxation – Car Subscription

Monthly rates can be deducted as business expenses

No depreciation write-offs since there’s no ownership

Simple accounting with fixed monthly costs

No VAT input tax deduction on acquisition

Taxation – Car Purchase

Depreciation over the vehicle’s useful life is possible

Maintenance, insurance, and repair expenses can be claimed

VAT input tax deduction possible (if eligible)

More complex bookkeeping due to varied cost items

Legal Aspects

With a car subscription, legal issues are mostly handled by the provider (registration, insurance, etc.). With ownership, you bear full legal responsibility for your vehicle.

Environmental and Sustainability Considerations

Car Subscription & Sustainability

Often newer vehicles with advanced eco-friendly technology

Optimized usage through shared fleets

Regular fleet renewal with more efficient models reduces resource consumption

Car Purchase & Sustainability

Longer vehicle use can be more eco-friendly

Full control over selecting particularly green models

Risk of driving outdated technology longer

Technological Developments and Future Prospects

The automotive industry is undergoing radical change: electric mobility, autonomous driving, and connected cars are reshaping transportation.

Impact on Subscriptions

Easy access to the latest technology

Ability to test different drivetrains

Providers can quickly adapt to technological changes

Minimal risk of owning outdated technology

Impact on Car Buying

Higher risk of rapid depreciation due to technological shifts

Ability to stick with proven technology

Greater investment risk with new tech

Longer-term commitment to chosen technology

Conclusion

There is no one-size-fits-all answer to the car subscription vs purchase debate. The right choice depends on your personal circumstances, mobility needs, and preferences.

Car purchases remain the better option for long-term drivers with stable needs, high mileage, or those seeking a deeper connection with their car. Economically, buying can be more advantageous over time if you keep the car for many years.

Car subscriptions are perfect for those valuing flexibility, convenience, and predictable costs - especially during transitional phases or when planning for the future is uncertain.

Explore our cars on subscription to find the perfect car for your needs!